LAPP is a defined benefit pension plan. Your pension is based on a formula that looks at your salary and your years of service, and not how much you've paid into the Plan. The longer you're contributing to the Plan, and the higher your salary gets, the larger your pension will be.

A quick way to calculate your pension is to use one of the estimator tools provided by LAPP:

A member has a highest average salary of $68,000 and has worked full-time for 25 years.

Here is how that information works in the pension formula.

$58,700

(averaged YMPE) x 1.4% x 25 years = $20,545

+

$9,300

(salary over the averaged YMPE) x 2% x 25 years

= $4,650

= Estimated annual unreduced pension is $25,195, or $2,099.58 per month.

Eligible members will receive a temporary benefit improvement of a lifetime pension based on 1.8% of their highest average salary (instead of 1.4%) up to the average year’s maximum pensionable earnings (average YMPE) for pensionable service in 2027. Read more about it here.

A full-time member is normally expected to earn one year of service per calendar year.

A part-time employee will earn less service based on what percentage of full-time hours he or she works. You might even work in multiple positions, or for more than one LAPP employer, but you can't earn more than one year of service per year.

If you work part‐time for a LAPP employer, your service and salary are still the basis of your pension formula, but you will not build up your pensionable service as fast as if you worked full-time.

Service

For this example, Nancy works part-time at a hospital and her hours worked are half as many hours (sometimes called a 0.5 position) as someone who works full-time. That means she works 50% of what a full-time employee would, so over 25 years she will earn 12.5 years of pensionable service.

Salary

For this example, Nancy's highest average salary in a part-time (0.5) position is $34,000. The pension calculation is based on what her salary would be if she worked full-time. So, if Nancy had worked full-time over the same period, her average salary would have been twice as much: $68,000 per year. We use this figure when calculating her pension, and not her actual salary. This is what we call her annualized salary. You can see an example of how this is calculated below.

$58,700

(averaged YMPE) x 1.4% x 12.5 years = $10,272.50

+

$9,300

(salary over the averaged YMPE) x 2% x 12.5 years

=$2,325

= Estimated annual unreduced pension is $12,597.50,

or $1,049.79 per month.

Eligible members will receive a temporary benefit improvement of a lifetime pension based on 1.8% of their highest average salary (instead of 1.4%) up to the average year’s maximum pensionable earnings (average YMPE) for pensionable service in 2027. Read more about it here.

I work part-time or casual and would like more information on how this affects my pension.

If you're interested in seeing the formula and reading about about how all the parts of the formula work together, you can do so below:

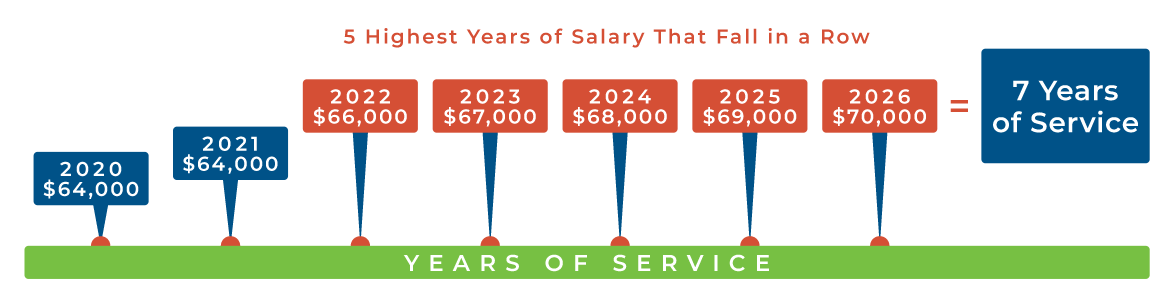

The salary we use in the formula is called your highest average salary, which uses the five years in a row where your average salary was the highest. Those are often, but not always, the last five years of a LAPP member's career.

The maximum annual salary that can be used in your pension calculation for 2026 is $218,991.00. This is called the salary cap.

The service we use in the formula is your pensionable service in LAPP, to a maximum of 35 years.

Your pension will be calculated differently depending on whether you work full-time or part-time.

In the pension formula, salary above the Year's Maximum Pensionable Earnings (YMPE) is separated from the salary below the YMPE. In 2026, the YMPE is $74,600.

What is the Year's Maximum Pensionable Earnings?

LAPP is an integrated pension plan because it's designed to work with the Canada Pension Plan (CPP). This is why the LAPP formula uses the CPP’s Year’s Maximum Pensionable Earnings.

You only pay into the CPP up to the YMPE, which is an amount set by the Government of Canada every year. The 2026 YMPE is $74,600.

I'd like to know more about how the YMPE affects how much I pay in pension contributions

This is what the formula looks like:

Salary up to the YMPE x 1.4% x Service = $_______

PLUS

Salary over the YMPE x 2% x Service = $_______

(Remember, we're using an average of five years for your salary, and the average of the YMPEs for the matching years.)

The two totals are added together to give you an estimated annual unreduced pension.

The final amount of your pension is based on when you retire and the pension option you choose at retirement.

Read all about the governance, oversight, and operational functions that ensure your LAPP pension is on track.

Your Pension Profile allows you to view your information, send documents, and request assistance and more via Secure Messages!

Try out the LAPP Pension Estimator and access printable forms, member newsletters, annual reports, investment information and more.