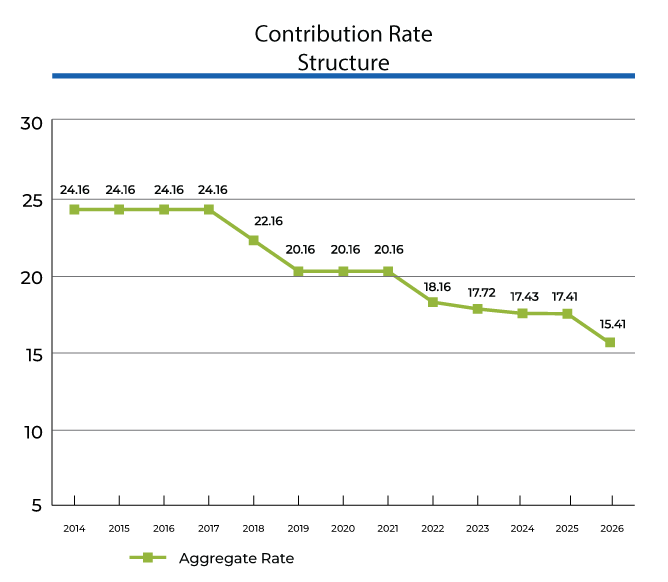

Following the annual actuarial valuation, the LAPP Sponsor Board announced that contribution rates for 2026 will temporarily decrease.

The total combined (aggregate) contribution rate (employers and employees) for 2026 is 15.41% of pensionable salary. Employers match employee contributions and pay an extra 1%.

These contributions go toward covering current service, which is the cost of estimated future pensions to members who are actively contributing to LAPP. Current contribution rates can always be found on the Contributions page.

Learn how the LAPP pension fund is professionally managed to provide you with a secure retirement income.

Gain valuable information on how your pension will help support you in retirement.

Discover information and tools to help you understand and manage your LAPP pension through every step of your career.