You will receive a tax slip from us if you’re receiving a LAPP pension, you received a lump sum payment last year, or you purchased service through LAPP. Your pension tax document is required to file your annual taxes.

Your Tax Slip

Your tax slip is a summary of income from the pension plan(s) as well as the amount of tax withheld and is used when you file your annual tax return. It will also include any other pension payments where the pension benefit administration services are provided by Alberta Pensions Services Corporation (APS).

When will I receive my tax slip from LAPP?

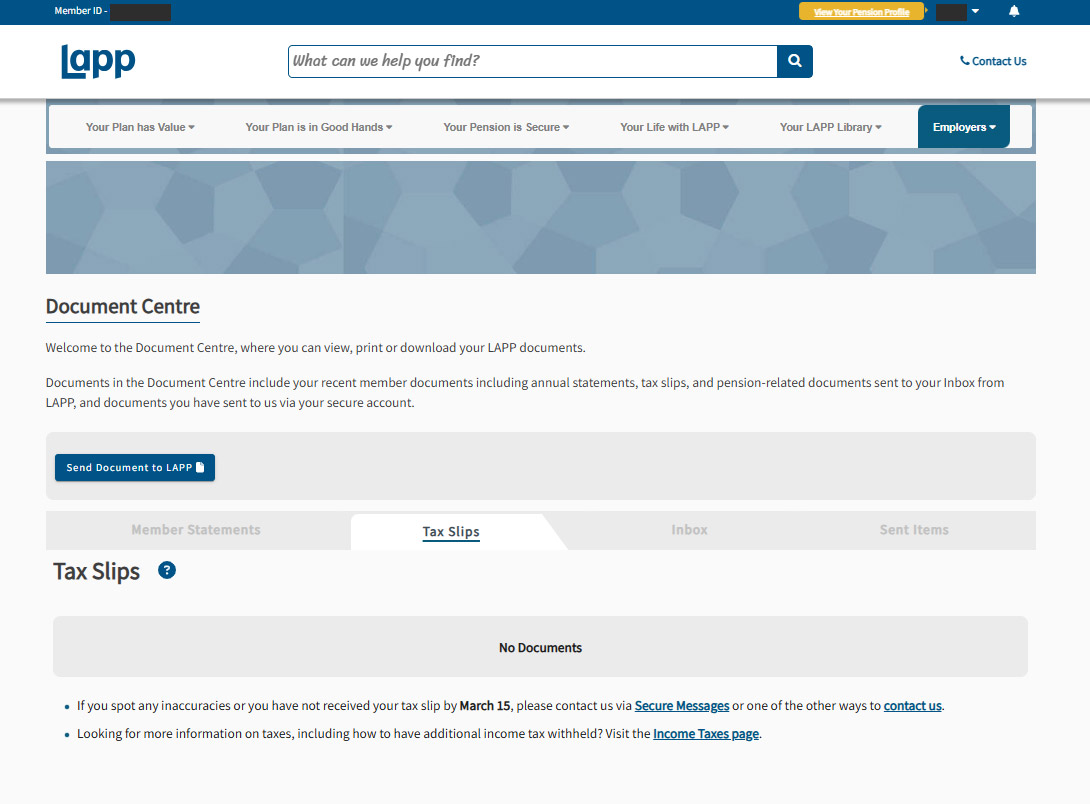

All tax slips are posted to the Document Centre in Your Pension Profile in February. You can access your tax slip by logging in to your secure online account and selecting Document Centre from the drop-down menu in the top right. From there, select the Tax Slips tab in Document Centre to view your tax slip.

If you’re not registered for the Go Green program, you will receive a printed tax slip in the mail. Mailed tax slips are sent out by the end of February and should arrive by the middle of March.

To find out more about accessing your tax slips online, read 'Online Tax Slips' below.

How much tax is deducted?

When calculating your tax deductions, we assume that your only source of income is your LAPP pension and any other pensions paid by APS, LAPP's pension benefits administration service provider. We don't know what your other sources of income might be, and the tax withheld is based only on your pension income. This means other income might push you into a new tax level.

We also assume that you qualify for the Basic Personal Exemption if you live in Canada, unless you tell us otherwise by submitting a form from the Canada Revenue Agency (CRA). Government tax rates can change from time to time, and you can review the amount of tax deducted from your pension on Your Pension Profile.

If you have any questions, we recommend you speak to an accountant, tax preparer, or the CRA.

Can you deduct additional taxes?

If you have income from other sources, such as government pensions or working during retirement, you may request that additional tax is taken off your LAPP pension payment to avoid owing at tax time. If you want to increase the tax deducted from your pension, contact us.

I'm receiving a large refund from the government at tax time. Can you deduct less tax from my pension?

If you receive a large refund, we may be deducting too much tax. We can reduce the amount deducted if you qualify for additional and eligible tax credits. You might be able to apply for tax credits if you become disabled, turn 65, support certain dependents, or go back to school.

If you wish to claim additional exemptions, or no exemptions, complete the federal TD1 and the TD1 forms for the Canadian province you live in and submit them to us through Document Centre (available by logging in to Your Pension Profile) or by using one of the other ways to contact us. New forms can be submitted any time you need to change exemptions. However, a new form must be completed no later than seven days after there is a change in your entitlements to federal, provincial or territorial personal tax credit amounts.

You can also ask the CRA for permission to reduce the amount of income tax withheld from your pension for deductions and tax credits that you cannot claim on the TD1. These include large charitable donations, support payments required under a divorce or separation agreement, childcare expenses, and allowable RRSP room (possibly carried forward from your working years).

In order to request a reduction, you must complete the T1213 form. If the CRA approves your request, you will receive a written authorization to deduct less tax, which you can then send to us through Document Centre (available by logging in to Your Pension Profile) or by using one of the other ways to contact us.

All tax slips are posted to the Document Centre in Your Pension Profile as soon as they are available . You can access your tax slip by logging in to your secure online account and selecting Document Centre from the drop-down menu in the top right. From there, select the Tax Slips tab in Document Centre to view your tax slip. You can find them there at any time during the year.

Register for Your Pension Profile

Registering for Your Pension Profile allows you to access and manage your personal pension information online. Click on the login button at the top right corner of LAPP.ca to get started. For more information on how to register and log in, check out the Log-In Help page.

Go Paperless

After you register for an account with Your Pension Profile, you can choose to 'Go Green' and stop receiving printed versions of some LAPP documents, such as Pensioner Annual Statements and tax slips. You don't have to be signed up for Go Green for your tax slips to be accessible online. Signing up for Go Green means that you won't receive a print version.

Find Your Tax Slips

To find your tax slips online, follow these steps:

The screenshot below shows where you will find the tax slips in Document Centre once you are logged in.

Save and Print Your Tax Slips

In a few simple steps, you can save and print your online tax slips.

If you move out of Alberta or Canada, please update your contact information as soon as you can so that your provincial or out-of-country tax rate can be adjusted, if necessary. You can update your address and contact information by using Your Pension Profile, sending us a message via Secure Messages, or by using one of the other ways to contact us.

Many countries have tax agreements with the Government of Canada, which means your income may be taxed at a lower rate. You can find a listing of these agreements and tax rates on the Government of Canada's Benefits for Canadians Living Abroad page. If the country you are moving to or live in does not have a tax treaty with Canada, your LAPP pension will be taxed at a standard 25% rate.

You may have gone from one source of income while working to several now that you are retired. In addition to your LAPP pension, you might have payments from the Canada Pension Plan (CPP), Old Age Security (OAS) and other retirement investment income. You might even return to work.

You can put your calculator away; taxes are already deducted from the monthly pension payment you receive. The income tax we deduct varies based on government requirements and what information you have provided, especially the Canadian province, territory, or country in which you reside. You can review the amount of tax deducted by logging in to Your Pension Profile.

Your Pension Profile allows you to view your information, send documents, and request assistance and more via Secure Messages!

Discover information and tools to help you understand and manage your LAPP pension through every step of your career.

Try out the LAPP Pension Estimator and access printable forms, member newsletters, annual reports, investment information and more.